Forget the hush of lecture halls or the monotony of textbooks. I turned my home into a real-life money management class for my kids. Using a tool as intriguing as Hire and Fire Your Kids, I sparked my children’s interest in finance early on, honing their skills for a future where money decisions can make or break their comfort level.

Sounds unusual? It was a ride! It’s as if I’d combined a simulation video game with a master class in personal finance. For roughly three years,

I used Hire and Fire Your Kids, an interactive platform designed to help kids understand money management. Brace yourselves, folks. I’m about to take you on a journey of tears and triumphs, giggles and grumbles, dollars gained and spent – all in the noble pursuit of teaching my kids about money.

How I Used Hire and Fire Your Kids to Teach My Kids About Money

Step 1: Understanding the Concept of Hire and Fire Your Kids

Making a dent in the world of parenting and financial education, Hire and Fire Your Kids is a revolutionary approach that parents across the globe are warming up to.

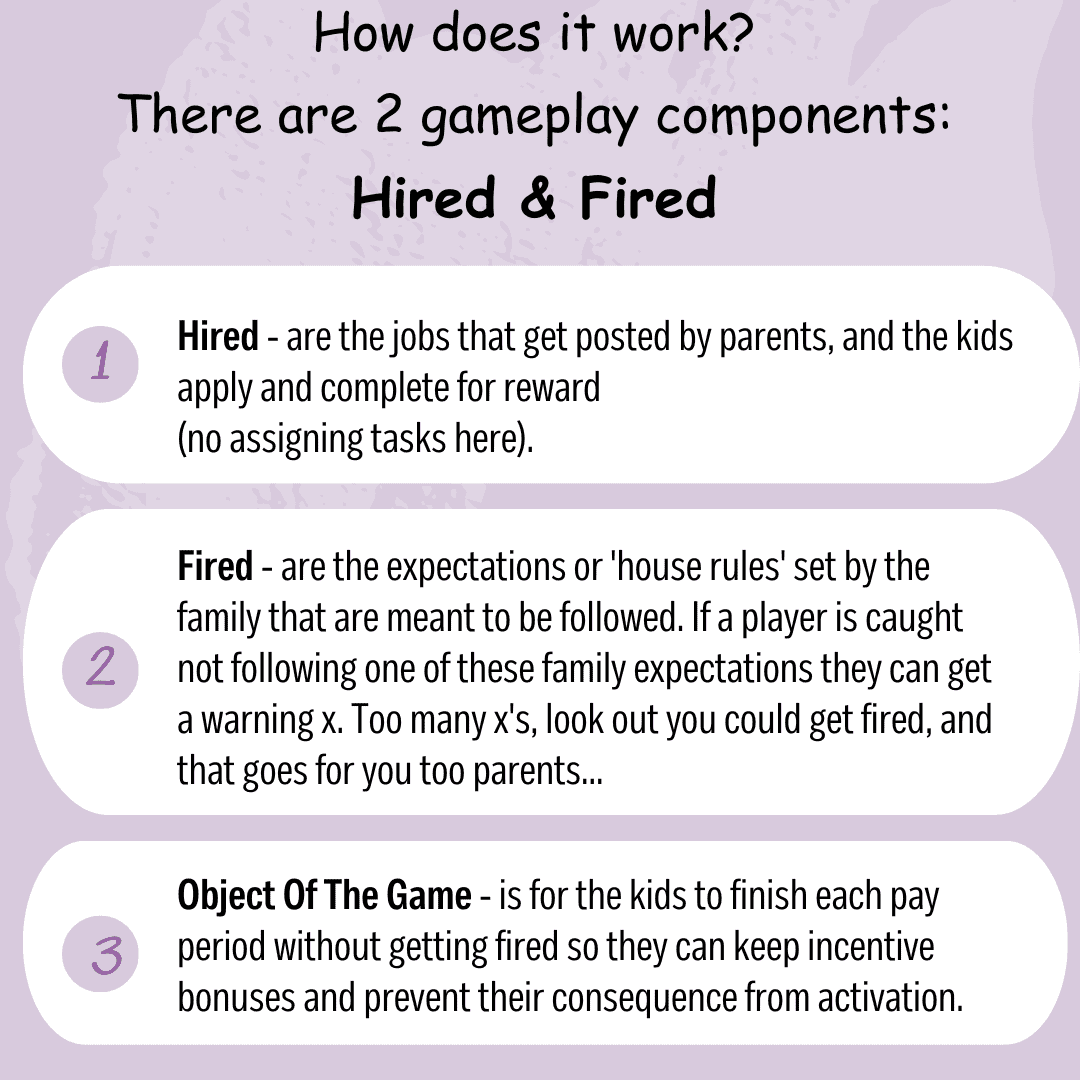

I was intrigued by this simple yet clever idea that promotes skills like money management, responsibility, and value of work among younger minds. The premise was straightforward: Post jobs for ‘hire’ and let your kids ‘apply’ and complete for reward then ‘pay’ them for their ‘work’ on ‘payday’.

They could use this fictitious money called kids kash for their desires and needs, in turn understanding the core basics of earning and spending money diligently. A fresh and engaging way to induct real-world concepts to young brains, I found this approach worth trying out in my household.

Step 2: Introducing the Concept to My Kids

Like any new concept, it was initially a bit of a challenge to explain Hire and Fire Your Kids to the little ones. Unlike conventional methods, this approach treats kids more like accountable individuals rather than passive recipients of pocket money.

The emphasis was on having the kids earn their wants through completing jobs that I posted to the rolling job board. I just had to set the jobs and forget it! I can post age-appropriate chores that align with my kid’s developmental age. The kids would begin to appreciate the effort behind every cent as it was their hard earnings not mom and dads. Through interactive family meetings, visuals, and scenarios, this idea started to settle in their young minds, setting the stage for the real application.

Step 3: Implementing the Concept

Finally putting the theory into practice, we downloaded the app onto our kids devices and used the web app on our family computer, As a family we came up with the jobs we were prepared to reward our kids for, got their buy in with the reward amounts for each job and went through what ore family values and house rules were. Things like helping with the laundry, watering plants, or finishing homework on time, my kids started earning money for every completed job. The culmination lies in a monthly ‘paycheck’ and a performance evaluation, bringing a level of seriousness, accountability, and pride in their actions.

Realizing the connection between effort and rewards, spending and earning, and the importance of job well done was an ongoing learning process. Progress wasn’t swift, but the gradual change in their attitude towards work and money was proof of the effectiveness of this program.

The result was not only a better understanding of money management but also improved family dynamics, with children feeling a sense of ownership for their actions and contributions to the family.

The Impact of Hire and Fire Your Kids on My Kids’ Financial Education

Improved Understanding of Money

The Hire and Fire Your Kids app significantly transformed my kids’ perception of money. It was no longer an abstract concept only dealt by grown-ups; it had now become something they could touch, earn and manage. They began to comprehend the value of a dollar and the effort needed to earn it, thanks to the real-world implications of this game-of-life approach to financial education.Teaching kids about money: financial literacy for children (msn.com)

After a few months into the game, they surprisingly started asking questions about saving and spending wisely. An unexpected result was that they also understood the value of hard work, needs and wants and its direct correlation with earnings. The app paved the way for profound observations, discussions about the purpose of money and the importance of fiscal responsibility.

This hands-on experience helped them grasp the value and the uses of money. The beauty of this journey was that learning occurred through experience, not just through theoretical explanations or seemingly random lessons. This method of teaching left lasting impressions that they could actually relate to and understand in the safety of our own home.

Enhanced Money Management Skills

Through my exploration of Hire and Fire Your Kids, I witnessed my children grow into competent money managers —a transformation that left me astounded. The app taught them the essentials of budgeting, saving, and responsible spending, all with a seasoning of fun.

The Hire and Fire Your Kids app, along with regular family financial discussions at our family team meetings, served as a potent combination that instilled in them a sense of financial responsibility and independence. It was rewarding to see them make thoughtful decisions about their earnings, whether it was deciding to save for a coveted toy or choosing to spend on an immediate gratification. They started to see the money they had earned as a limited resource, and thus extremely valuable.

Moreover, they learned to appreciate money not as a goal unto itself, but as a means to achieving their own objectives, such as buying that toy they had been hankering after or going to the movies with friends.

In conclusion, my personal experience with Hire and Fire Your Kids has been incredibly rewarding, not just for me but, most importantly, for my kids as well. They’ve gained a robust understanding of money and enhanced their money management skills — benefiting from the real-world scenarios and decisions the app presents. The lessons they learned have set them up for future financial success.

Why Choose Hire and Fire Your Kids for Teaching Kids About Money

Real-world Parenting Approach

Hire and Fire Your Kids is not just an app; it’s a revolutionizing parental strategy endorsing the adoption of financial lessons into a child’s daily routine. It takes inspiration from real-world concepts, integrating responsibilities, earnings, and savings into an interactive game, making the lessons more tangible and enjoyable.

By encouraging the kids to take initiative and apply for the jobs that they want to do within the app, children not only learn the importance of work but also the accompanying rewards just like the real world.

This approach invites children to view finances from a grounded perspective, while echoing the importance of expenditure and revenue balance. It allows them to take charge of their financial decisions, thereby instilling the sense of responsibility associated with money.

Easy to Use App

Next, the intuitive design of the Hire and Fire Your Kids app is a major contributing factor to its success. Oversaturated with complex tools that often leave parents feeling overwhelmed, the industry needed a change— and this app brought that.

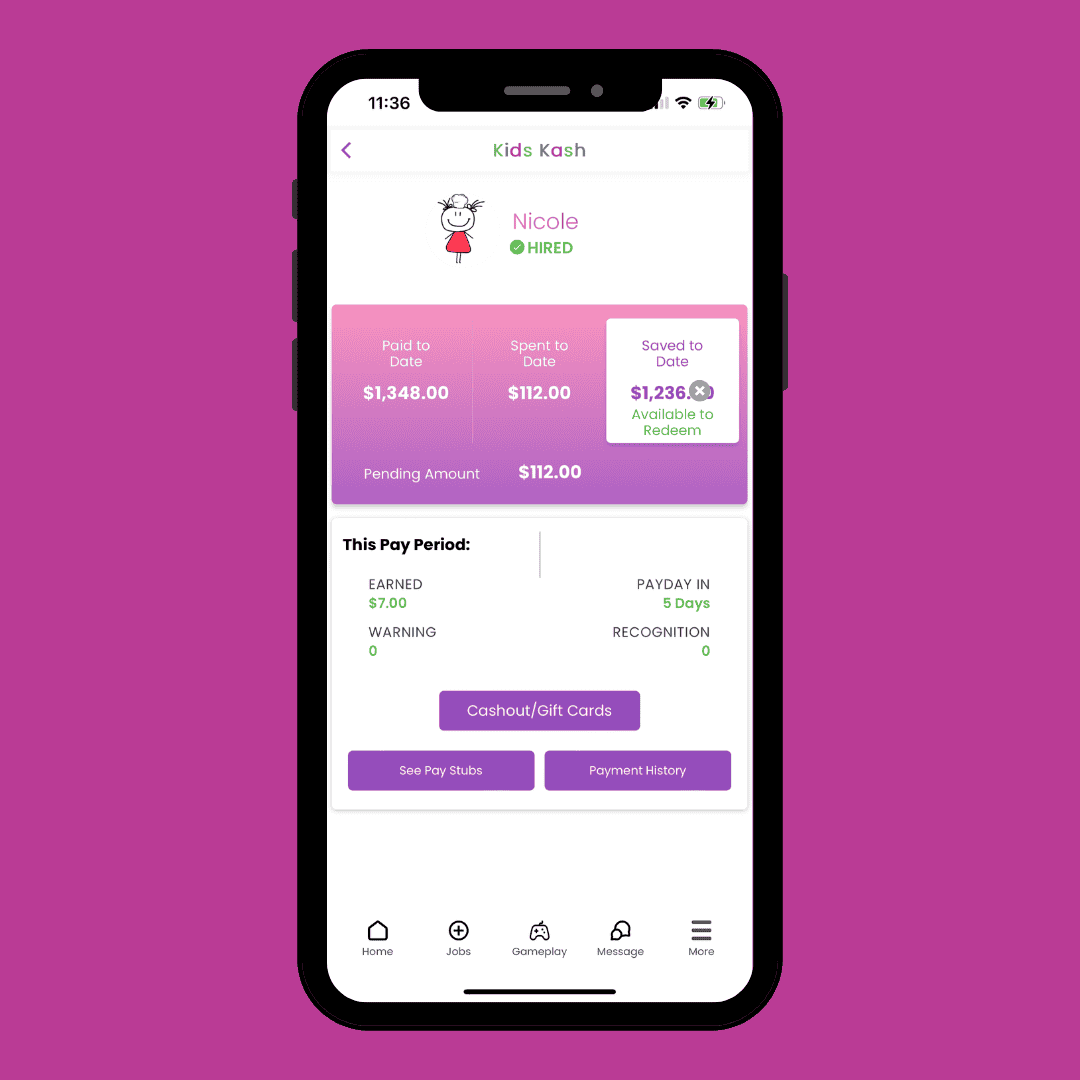

The application offers a streamlined design with a user-centered approach. Parents and kids can easily navigate through various features like jobs, expectations, leaderboard, kids kash virtual wallet, earning, spending, and saving all tracked through paystubs and a payment history tracker.

A major highlight is gameplay stats tracking: the software records the child’s monetary progress, enabling users to monitor and assess their financial growth.

Personal Experience and Recommendations

Lastly, I would like to share my own experience with the Hire and Fire Your Kids app. My children and I embarked on this financial education journey together, and the transformation was palpable. Their understanding of money, savings, and responsible spending increased exponentially.

Two remarkable changes stood out particularly. First, their willingness to take more proactive responsibility around the house, eager to earn their paycheck. Secondly, there was a noticeable shift in their mindset around frivolous purchases; they started considering the work they had put into earning that money and was it really worth it, did they really want it so much that they would spend some of their paid earnings.

My personal experience illuminates the app’s practicality: delivering an efficient and engaging way to teach kids about finance. I recommend it unreservedly to parents looking for realistic and relatable ways to introduce money management to their kids.

Having experienced firsthand the difference this approach can make, I firmly believe that Hire and Fire Your Kids revolutionizes financial education strategy for the new age of parenting.

What is Hire and Fire Your Kids?

The Concept Behind Hire and Fire Your Kids

Hire and Fire Your Kids doesn’t have the harsh implication its name suggests. It is a revolutionary tool in the form of a game aimed at keeping parents and kids accountable, reducing family friction and helping parents connect and digitally communicate with their children and teens while preparing them with household responsibilities, money management and life skills for a successful future. It flips around the traditional parent-child relationship, letting kids earn ‘paychecks’ through household chores and behaviors.

Understanding Independence and Accountability

The concept is about more than just finances. Hire and Fire Your Kids is an out-of-the-box method to instill independence and accountability in children. It teaches them the consequences of their actions through actual rewards and warnings, making the lessons more tangible and impactful. This unique methodology underpins a core principle – discipline and responsibility are critical elements in personal and financial success.

The Hire and Fire Your Kids App

The Hire and Fire Your Kids app is a user-friendly platform that adds a tech aspect to this concept. It puts various features at your disposal that you can use to teach your kids about the value of hard work, commitment, and managing money.

In-app Jobs List

To make the teaching process easy and systematic, the app provides a chore list function. It empowers parents to allocate tasks and track job completion, making the game more immersive and engaging.

Digital Checkbook

To further enhance the finance teaching, the app has a built-in digital checkbook function using kids kash currency. Kids can see their earnings, set and manage their savings, and learn the basics of budgeting and expense tracking, which are skills that will serve them for the rest of their lives.

The Impact of Hire and Fire Your Kids

The impact of Hire and Fire Your Kids is substantial, it revolutionizes how kids perceive work and allowance management.

Developing Financial Responsibility

Children just don’t understand the value of money; it’s an abstract concept. By integrating their daily chores with monetary rewards and warnings, Hire and Fire Your Kids makes it real for them. They understand the cost of luxury and the value of money management. They learn financial literacy from a young age.

Fostering Work Ethic

Developing a strong work ethic is one of the underrated aspects of the Hire and Fire Your Kids program. The philosophy that you earn what you work for is a crucial life lesson, which this app teaches elegantly. The child learns to associate effort with reward, setting the stage for a good work ethic.

Parent-Child Bonding

The Hire and Fire Your Kids exercise can work as a family bonding activity. It lets the children see their parents as mentors rather than authoritarian figures, creating a more open and healthy parent-child relationship.

Having understood the concept, application, and the powerful impact of Hire and Fire Your Kids, we can now look at it with more appreciation. It is more than just a game; it’s an innovative and successful method of teaching kids about money.

Final Thoughts on Teaching Kids About Money Using Hire and Fire Your Kids.

The Importance of Financial Education for Kids

Engaging kids in financial education has transformative implications, not just for their childhood but for their adult lives as well. Take note: we’re talking real-life skills here, not the run-of-the-mill knowledge contained in textbooks. Dealing with money confidently and appropriately is one of the most underrated but pivotal skills one can possess.

A grounded understanding of finances from an early age propagates a sturdy foundation for children as they navigate through an adult world filled with bills, mortgages, and taxes. This knowledge helps children evolve into financially responsible adults who can make intelligent fiscal decisions, avoid common money mistakes, and maintain financial stability. Armed with a sturdy grasp of financial management principles, your kids could be one step closer to becoming the responsible adult you’ve always wanted them to be!

My Personal Journey with Hire and Fire Your Kids

Hire and Fire Your Kids is more than just a tool—it’s a hands-on, immersive experience that taught my kids the value of money, work ethics, and responsibility—all within a fun yet realistic framework. This journey wasn’t just about counting pennies and nickels, but fostering a mature understanding of essential life concepts.

My kids stepped into adult shoes as they ‘worked’ for their allowances, ‘applied’ for jobs, and even ‘faced the sack’ when they didn’t meet requirements. It wasn’t just about the accumulation of wealth but understanding its worth and the labor attached to earning it. This interaction with Hire and Fire Your Kids has undoubtedly left an indelible imprint on my kids’ perception of money and work.

Encouragement for Other Parents

My advice to other parents—is to jump in. While teaching your kids about money may feel daunting, remember—one doesn’t need to be a finance whiz to impart a basic understanding of financial responsibility.

Hire and Fire Your Kids is a fantastic platform that can supplement your efforts without requiring you to hold a finance masterclass. It’s a novel, exciting, and immersive way to expose kids to crucial life lessons, all while retaining an element of fun. It’s worth giving it a spin!

Applying the Lessons: Your Child and Money Management

Using Hire and Fire Your Kids has been immensely beneficial in teaching my own children about money. Transforming ordinary household tasks into job opportunities brought about a fundamental shift in their thinking. It showcased the value of hard work and the reward of earning, saving, and spending responsibly.

Remember, the principles of earning and managing money are crucial for children to learn before they become adults. It’s never too early to start. Using Hire and Fire your Kids, you can lay a strong foundation for your kids’ financial future.

Now, are you ready to guide your children to financial literacy? If you’ve had an experience with this, were there any specific challenges you encountered?

You have all the tools on hand. It’s time to open the world of money management to your children. Let’s not just teach our kids how to count money. Let’s prepare them to count on themselves.